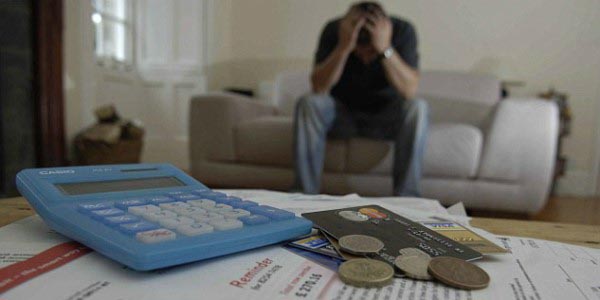

A lot of us like to think that debt is the American way and that nobody is immune. This kind of thinking led to the 2008 recession as well as a lot of pain and stress for millions of Americans all over the country. Being in debt has a way of affecting your mental state, especially if it’s your first time to rack in a huge amount owed by you to different sources such as the bank, credit card companies and loan providers. Debt can do some serious damage to your mind, body and psyche if left unchecked. In this post, we’ll take a look at some of the emotional and psychological effects of debt and what you can do about them.

Being in Debt and Fear

Fear is an instinctual and powerful emotion that may have served its purpose during the early evolutionary period of man. It was useful in our survival as a species in the face of dangerous animals, helping us flee from the offending animal as fast as our legs can carry out. The problem with reacting in a fearful manner when it comes to the debt you’ve accrued over the months or years is that it can make you run away from your problems as well as stop you from seeing that what you’re mentally running away and hiding from isn’t as scary as it seems.

If you’re looking to get your fear in check, you may want to start by making small steps towards tackling your debt. One way you can do this is by automating debt payment so that you’re not hit with a wave of apprehension every time your monthly bills come in.

Being in Debt and Low Self-Esteem

We all have dreams of a better life. Progress is the only way to live life, and almost everyone would like to have their finances under control. Debt, on the other hand, has a way of sneaking up on us, causing untold misery. A lot of people identify with their debt and come to the erroneous conclusion that they are not good people on account of their spending habits. If you find yourself being hard on yourself, it’s important to stop and think and take stock of your life. We all make mistakes and learn from them. Beating yourself up will only lower your self-esteem. This will, in turn, make it hard for you to make sound decisions going forward when it comes to deciding how to tackle your debt.

A great way of not getting yourself stuck in a vicious cycle of self-berating, self-pity and the resultant low self-esteem would be to forgive and give yourself some leeway every time you catch yourself doing this. Remind yourself of the many times you paid your bills on time and make sound financial decisions. Come up with a list of 10 things that you have achieved personally and financially and look at them every time you feel yourself going down the pity path.

Debt, Stress and Depression

The thought of tackling your debt can paralyze you with fear, making it hard for you to make the first step. This compounds your life’s stresses, which in turn shuts your mind down, leading to negative thoughts and feelings, and eventually depression. While this is a serious condition, it’s possible to get out of it with a bit of work. See a doctor if your depression is causing you not to function on a daily basis. Doing something such as exercising or seeing a debt counselor can help a great deal when it comes to beating the stress and depression related to stress.

At the end of the day, debt shouldn’t be in control of your life and emotional health if you follow the recommendations we’ve outlined in this article. The most important things are carrying out self-evaluation, being honest and taking action; these three can go a long way in helping you finally tackle your credit woes once and for all.