There are many factors to consider when selecting the best cash back rewards credit card. Credit card companies change their plans frequently, and most give the consumer a short window of opportunity to select their promotional plan.

Many consumers are enticed with emails and mailers from credit card companies that state “sign up now and get 40,000 free points.” A diligent consumer should first spend time researching alternative credit card companies before acting on that special offer. Make the right choice.

Cash Back Rewards

Obtaining money back or points from a credit card company is a great enticement to use your credit card more often. Before making that large purchase, be sure there will be sufficient money in your checking or savings account to pay off your monthly credit card bill. Credit card companies’ reward programs differ from one card to another. One size does not fit all. Check cardratings.com and compare which card gives you the most back when you spend money on groceries, gas, restaurants, and other purchases.

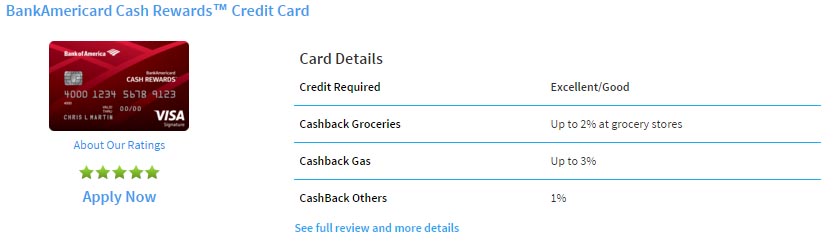

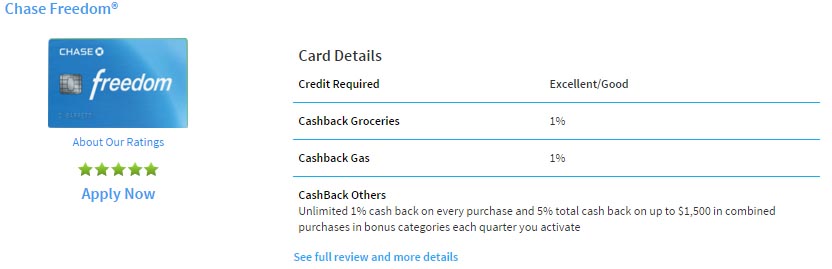

The following are the two “overall winners” for February 2016, but check their website to see which cash back rewards card is best suited for you.

Evaluation Criteria

CardRatings.com offers this advise when analyzing cash back rewards programs.

- What do you need: Think about this before applying. What’s your goal? You’ll make a better decision if you can visualize how and when you will use the rewards.

- What are the bells and whistles: 5% cash back is very catching, but if it’s in a category you’ll never use, that makes it 0%. Since many of us are creatures of habit, look at your past spending patterns as a guide for future purchases.

- Know your credit score: Applying for many different credit cards at once and get rejected can seriously damage your credit. Credit scoring companies such as FICO may assume you are in an emergency situation and are about to binge on credit. Apply only for cards that you are sure you will be approved for. The credit card comparison chart shows what type credit is required.

- Read the fine print: What are the fees on the back end that may wipe out any potential gains. Look beyond the teaser rates. What will trigger a rate increase? Are there any annual fees? Some deals are so alluring that paying an annual fee still nets out to a great reward. It’s best to look at this long-term.

- Change in lifestyle: Periodically review your spending situation and make sure your cards are working for you. Find a new card if the current one is not working for you or the credit card company changed their rewards program.

- Over spending: If you aren’t able to pay off the credit card balance in full each month, interest charges will eat away or perhaps negate any rewards.

- Miles or Rewards: This decision depends on an individual’s lifestyle and goals. To make the correct decision, look at the dollar equivalent of a mile or point then think about your use cases. If someone flies on a specific airlines twice a month, then the earning potential of getting that branded airlines credit card might allow the miles to accrue so fast that realizing rewards is a snap. If another consumer doesn’t fly or stay in hotels often, then a cash back card is the better and quicker path to getting the cash to spend on a flight or hotel stay in the future.

What card works for you?